According to the Federal Reserve, the average retirement savings of a person aged 45-54 is roughly $250,000. For someone between 55 and 64, it’s closer to $400,000. How does your bank account line up with these numbers?

Videos by Suggest

If the answer is “not great,” there’s still time to start racking up major retirement savings, especially if you’re in a two-income household. One strategy recommended by financial planners is to live off of a single income and devote the entirety of the other to savings and investments.

It might sound like a nightmare to pair down your lifestyle to bare bones, but after speaking to several experts, it’s actually a pretty feasible plan. From CPAs to financial planners to debt relief lawyers, the consensus is clear.

Not only is paring two-income households down to one a highly effective way to boost retirement savings—particularly in midlife and beyond—it’s also surprisingly possible. Here’s how to get started.

1. Plan And Delegate

“The basic idea is that, even in a dual-income household, you can live on one income while keeping the other to pay off your high-interest credit cards, build an emergency fund, invest it, or keep it as savings,” explained Lyle Solomon, a finance attorney in Auburn, California. “Keep the higher income to cover all the expenses for your living, and keep aside the lower paycheck for your financial goal.”

Consider which income you and your partner will use for living expenses and savings. This will give you a more accurate baseline for the following steps.

2. Consider Your Likeliest Hurdles

Jason Ramage, a financial advisor in Cincinnati, Ohio, stressed the importance of anticipating hurdles based on your income level. “For higher earners, the main roadblock will be lifestyle. That’s not just spouses and partners—expectations for gifts to family and how you spend time with friends may need to be communicated.”

RELATED: How Your Gen X Childhood Might Be Making Your Financial Life Miserable

3. Start Splitting It Up

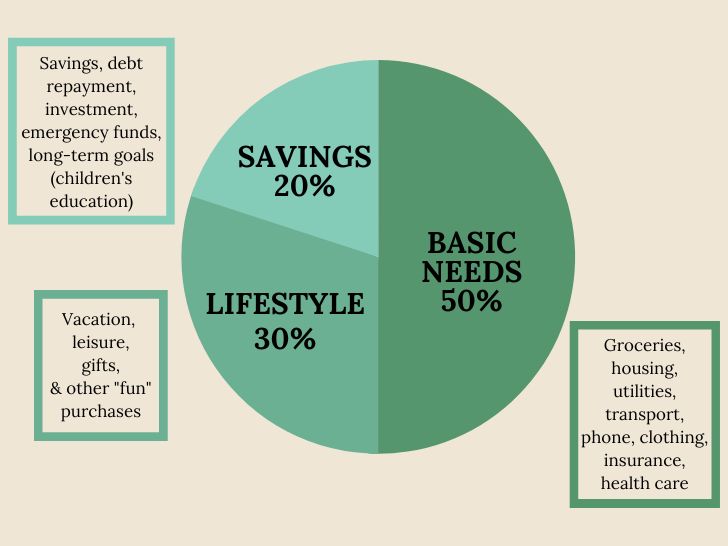

Once you’ve assessed where each income will go (and the obstacles you might face as a result), you can start divvying up funds. “A good starting point is looking into the 50/30/20 rule,” said Julien Brault, CEO of Hardbacon, a Canadian finance management app.

“Take the one income, allocate 50% to basic needs, 20% to savings and debt repayment, and 30% to pleasure. Now, this may seem like a really tight budget at first, especially if there are other dependents, such as children. However, a couple will have some wiggle room with the 20% because they already have 100% of the additional income going into savings.”

The graph above illustrates how Brault advises couples to split their finances according to the 50/30/20 rule.

RELATED: Why Joy Should Be A Category In Your Annual Budget, Especially At Midlife

4. Keep It Transparent

Brault also suggests keeping the reserved income as transparent and accessible as possible. They recommend both partners have access to the accounts “so that it’s not one person spending all their money, while the other accumulates a chunky bank account. Life can be unpredictable, and this arrangement should remain fair for both parties.”

“Consider the second saved income as an agreed-upon amount to save amongst one shared separate account,” Brault continues. “Then, divide the 50/30/20 spending among the personal accounts. For example, if one person pays the bills, the other buys groceries and gifts. This will help avoid strife and keep everyone happy in the long run.”

5. Ease Into It Slowly (And Stick To It)

Nearly every financial expert I spoke to emphasized the importance of easing into this lifestyle shift slowly. “A cold-turkey approach when it comes to finances will never work effectively,” warns Paul Sundin, CPA. “Start the process slowly, and have a plan in place.”

“Staying committed can be challenging,” adds Solomon. “It’s natural to feel burdened when you suddenly switch to living with one income. To make this more bearable, I recommend following it for a minimum of six to eight months, even when you want to give up. By the end, when they see the result, it becomes more of a habit and interest.”

6. Remind Yourself Of The Benefits

Switching from two incomes to one is a tough sell and a difficult process. Whether you need extra convincing or are experiencing some one-income woes, it’s important to continually remind yourself of this lifestyle’s benefits.

“Added flexibility, starting to feel financially free long before you reach any target savings number, possibly opening doors to a move, career change, or starting a business that felt too risky when you were spending both incomes,” are a few of the perks of this approach, Ramage said.

Saving for retirement can seem daunting, but there are ways to make it easier. Paring down to one income is a significant adjustment and, for some, not financially feasible. But if you can try to pinch pennies, hunker down, and live on one income, you might be surprised how fast the savings pile up.