Less than 50 years ago, women weren’t allowed to open a line of credit without a husband or male co-signer. The traditional expectation of a woman getting married, homemaking, and having children might seem antiquated—but it’s not that old.

Videos by Suggest

Still, an increasing number of women are choosing a single, child-free life. These women have focused on their careers, friendships, and personal growth, and their priorities fly in the face of outdated, misogynistic stereotypes.

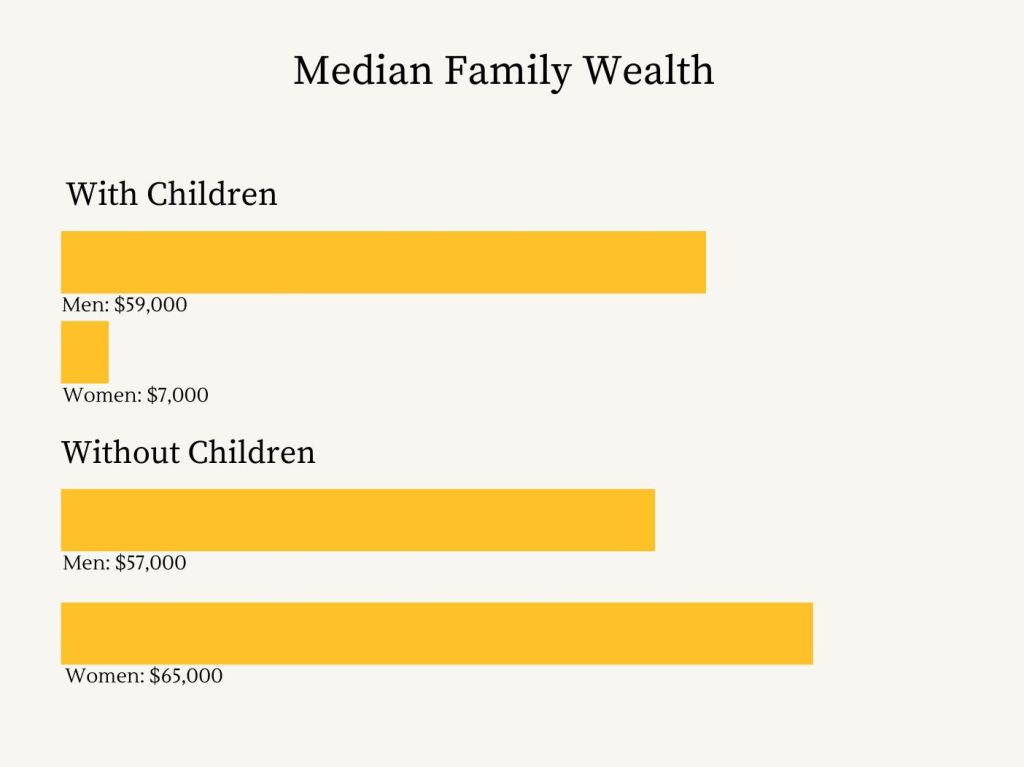

And as it turns out, these women are thriving. A 2019 report from the St. Louis Federal Reserve Bank showed the median wealth for single men and women—both with children and without—and the results were surprising.

While single men without children have a median family wealth of $57,000, single women without children’s media family wealth is $65,000, according to the Reserve’s research.

Childless women have greater earning power, more disposable income, and are happier than ever. So it’s unsurprising that a 2021 Pew Research Center study found that 44% of Americans aged 18-49 likely or definitely won’t have children.

The more wealth families have, the more secure they are in terms of housing, food, and overall financial well-being. So these numbers are exciting for single women without kids. But the results are tempered by what the study found about women with children.

How Children Affect Women’s Wealth

Gender inequality is nothing new in this country, but the disparity between single mothers and fathers is staggering. While single men with children have an average wealth of $59,000, a single mom’s average median wealth is $7,000.

No, that’s not a typo, and we didn’t forget a number. A single mother’s average wealth is less than 11% of a single, childless woman’s and 12% of a single father’s. For minorities, it’s even worse—single white mothers had around $46,000 in median wealth in 2019. Meanwhile, Black and Hispanic/Latina mothers had about $4,000.

RELATED: Where Do You Stand? The Average Retirement Savings By Age

Considering all this data, there appears to be little to no professional penalty for men with children. But when it comes to single moms, there is a noticeable motherhood penalty that disproportionately affects marginalized communities.

“Motherhood penalty” refers to the professional and financial setbacks experienced by women who have children. This can range from something as severe as getting fired to something as passive as being passed over for raises and promotions.

Julie Kashen, director for women’s economic justice at the Century Foundation, told Bloomberg that the motherhood penalty shakes out to around 15% of a woman’s annual income for each child under the age of five.

A Woman’s Right To Choose Shouldn’t Affect Her Wealth

The motherhood penalty is a double-edged sword. It’s also far more pervasive and complex than a simple “men vs. women” argument. While the gender pay gap is very real, the stark difference between women’s wealth with and without children is even greater.

This all but strips many women of the right to have both children and a career—or, at the very least, financial stability. The Brookings Institution estimates that the cost of raising a child through 17 is around $300,000. So, with a median wealth of $7,000, how can a single mother ever get ahead?

On the other hand, this alleviates pressure from the women who opt not to have kids. Society has long-judged women who remain single and/or childless. Indeed, motherhood has its fair share of guilt, but the guilt of not having kids is a heavy burden, too. The Reserve’s report shows that childless women aren’t just surviving—they’re flourishing.

RELATED: Can I Use Inflation To Negotiate A Raise? Financial Experts Weigh In

Considering just how recently women earned the right to professional and financial autonomy, it’s emboldening to see single, childless women outpacing their male counterparts. Hopefully, society can move toward closing the gap for those with children as well.